Stocks

Shares (stocks) is one of the most popular financial instruments. Issuing stock is one of the choices for company’s funding. Moreover, stock is investors' most favourite investment instrument because it offers them an interesting return rate.

General Information

Shares (stocks) is one of the most popular financial instruments. Issuing stock is one of the choices for company’s funding. Moreover, stock is investors' most favourite investment instrument because it offers them an interesting return rate.

Stock can be defined as a sign of capital participation of an individual or institution in a company or corporation. By investing in a company, the party has the claim for the company’s income, assets, and right to attend the General Meeting of Shareholders. test

Benefits

Basically, there are two benefits the investor can get by buying or having stock:

-

Dividend

Dividend is profit sharing given by company and comes from the income. Dividend is given after getting the agreement from shareholders in the General Meeting. If an investor wants to receive dividend, he/she must own the stock for a relatively long period, until the ownership term is in the period where he/she is acknowledged as the shareholder who has the right to obtain the dividend.

-

Capital Gain

Capital gain is the different between buying price and selling price. Capital gain is obtained through the trading activities carried out in the secondary market. For example, an investor buys ABC’s shares at Rp 3,000 per share and then sells it at Rp 3,500 per share. It means the investor gets capital gain of Rp 500 for every sold share.

Risks

As investment instrument, stock has risks:

-

Capital Loss

It is the reverse of Capital Gain. It is a condition when the investor sells his/her shares at lower price than its buying price. For instance, PT XYZ’s shares are bought at Rp 2,000 per share, but aftermath the stock price experiences decrease to the level of Rp 1,400 per share. Afraid of continuous declines, the investor sells the shares at price of Rp 1.400. The investor has retain a capital loss of Rp 600 per share.

-

Liquidity Risk

A company, whose shares are owned by public, is stated for bankruptcy by the Court or is being dismissed. In this case, the claiming rights of shareholders get the last priority after all the company’s liabilities are settled (by gathering the fund from selling the company’s assets). If there is an amount of rest of the company’s wealth, it will be shared proportionally to the shareholders. But, if there is no rest left, the shareholders will not receive anything out of the liquidation. This is the worst condition that might happen to shareholders. For that reason, a shareholder needs to observe every development in the company, which shares are owned.

In secondary market or daily shares trading activities, stock prices fluctuate, either increase or decrease. Prices are formed from the demand and supply of the stock. In other words, prices are formed by supply and demand. Supply and demand are influenced by many factors, either by specific factors such as the company and industry’s performance where the stocks exist or macro factors such as the interest rate, inflation, currency rate, and non-economical factors like social and political conditions, and so on.

Sector and Sub Sector Classification

Starting from January 25, 2021, IDX implements the new classification sector and industry of IDX listed company called "Indonesia Stock Exchange Industrial Classification" or IDX-IC. Further information can be accessed on the page of Stock Index (Click Market Data-Stocks index).

-

Energy (A)

The Energy Sector includes companies that sell products and services related to energy extraction which include non-renewable energy (fossil fuels) so that their income is directly affected by world energy commodity prices, such as Oil Mining, Natural Gas, Coal, and service providers that support the industry. In addition, this sector also includes companies selling alternative energy products and services.

-

Basic Materials (B)

The Basic Materials Sector includes companies that sell products and services used by other industries as raw materials for producing final goods, such as companies that produce Chemical Goods, Construction Materials, Containers & Packaging, Non-Energy Metal & Mineral Mining, and Wood & Paper.

-

Industrials (C)

The Industrial Sector includes companies that sell products and services that are generally consumed by industry, not by consumers. The products and services produced are final. This sector includes manufacturers of Aerospace, Defense, Building Products, Electrical Products, Machinery. In addition, this industry also includes providers of Commercial Services - such as Printing, Environmental Management, Industrial Goods and Services Suppliers - and Professional Services - such as Personnel Services and Research Services - for industrial purposes.

-

Consumer Non-Cyclicals (D)

The Consumer Non-Cyclicals Sector includes companies that produce or distribute products and services that are generally sold to consumers. The products and sevices are anti-cyclical or primary / basic goods so that demand for these products and services is not influenced by economic growth, such as Primary Goods Retail Companies - Food Stores, Drug Stores, Supermarkets -, Beverage Manufacturers, Packaged Foods, Agricultural Product Vendors, Cigarette Manufacturers, Household Goods, and Personal Care Items.

-

Consumer Cyclicals (E)

The Consumer Cyclicals Sector includes companies that produce or distribute products and services that are generally sold to consumers but for cyclical or secondary goods so that the demand for these goods and services is directly proportional to economic growth. This industry includes companies that manufacture Passenger Cars and their Components, Durable Household Goods, Clothing, Shoes, Textile Goods, Sporting Goods and Hobbies. In addition, this industry also includes companies providing tourism, recreation, education, consumer support services, media companies, advertising, entertainment providers and secondary goods retail companies.

-

Healthcare (F)

The Healthcare Sector includes companies that provide health products and services such as Healthcare Equipment Manufacturers, Healthcare Service Providers, Pharmaceutical Companies, and Research Companies in the Healthcare Sector.

-

Financials (G)

The Financials Sector includes companies that provide financial services such as Banks, Consumer Financing Institutions, Venture Capital, Investment Services, Insurance and Holdings Companies.

-

Properties & Real Estate (H)

The Properties and Real Estate sector includes companies that develope properties and real Estate as well as support service providers.

-

Technology (I)

The Technology Sector includes companies that sell Technology Products and Services, such as Internet Service Companies that are not internet connection providers, IT Service Providers, IT Consultants, Software Development Companies, Manufacturers in Network Equipment, Computer Devices, Electronic Devices and Components, and Semiconductors.

-

Infrastructures (J)

The Infrastructure Sector includes companies that play a role in the construction and procurement of infrastructure, such as Transportation Infrastructure Operator Companies, Civil Building Construction Companies, Telecommunications Companies, and Utility Companies.

-

Transportation & Logistic (K)

The Transportation and Logistic Sector includes companies that have a role in transportation and movement activities such as transportation and logistic providers and delivery service providers.

-

Listed Investment Product (Z)

The Listed Investment Products Sector includes investment products listed on the Indonesia Stock Exchange.

Click here for more information about List of Stock sector.

Listing Board

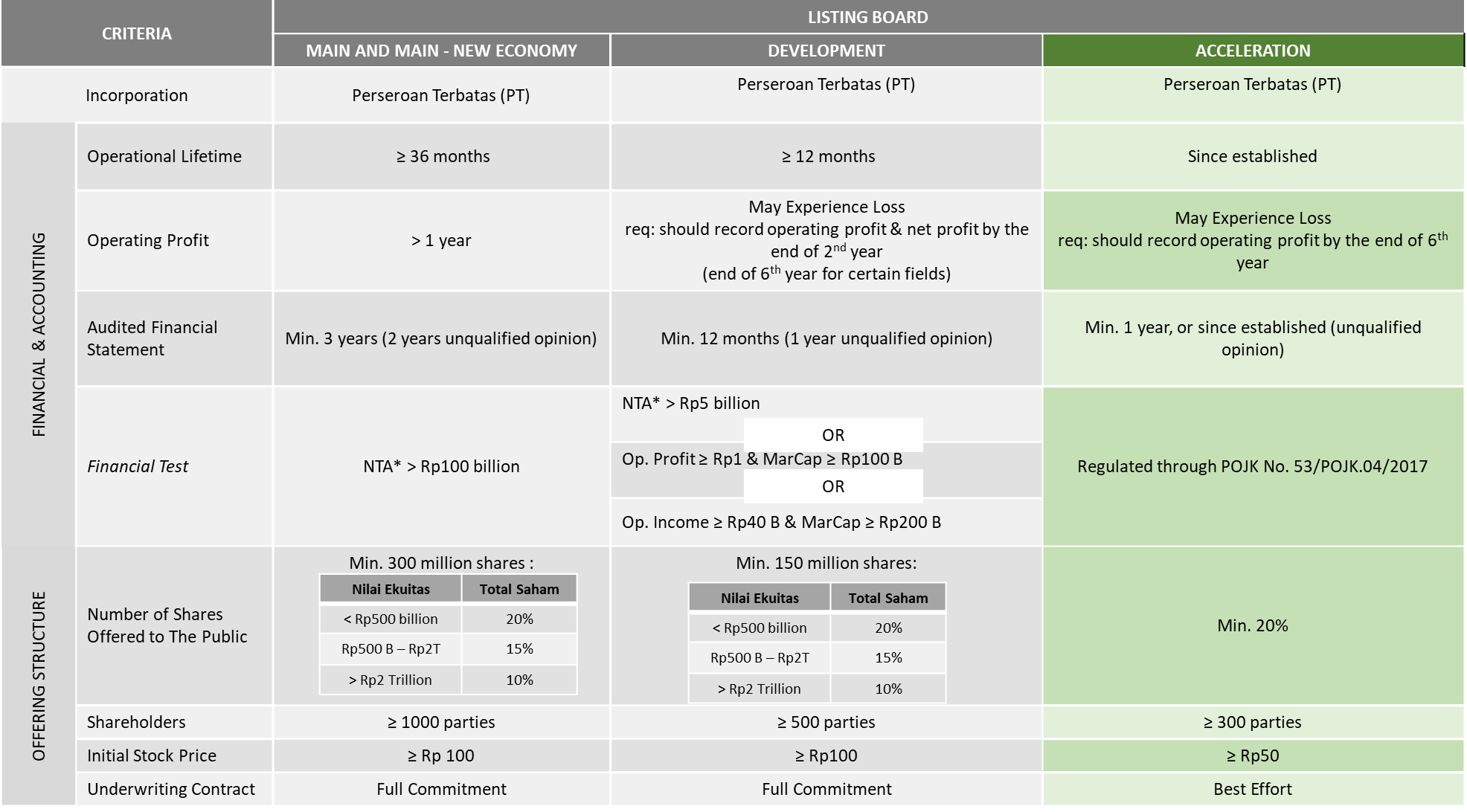

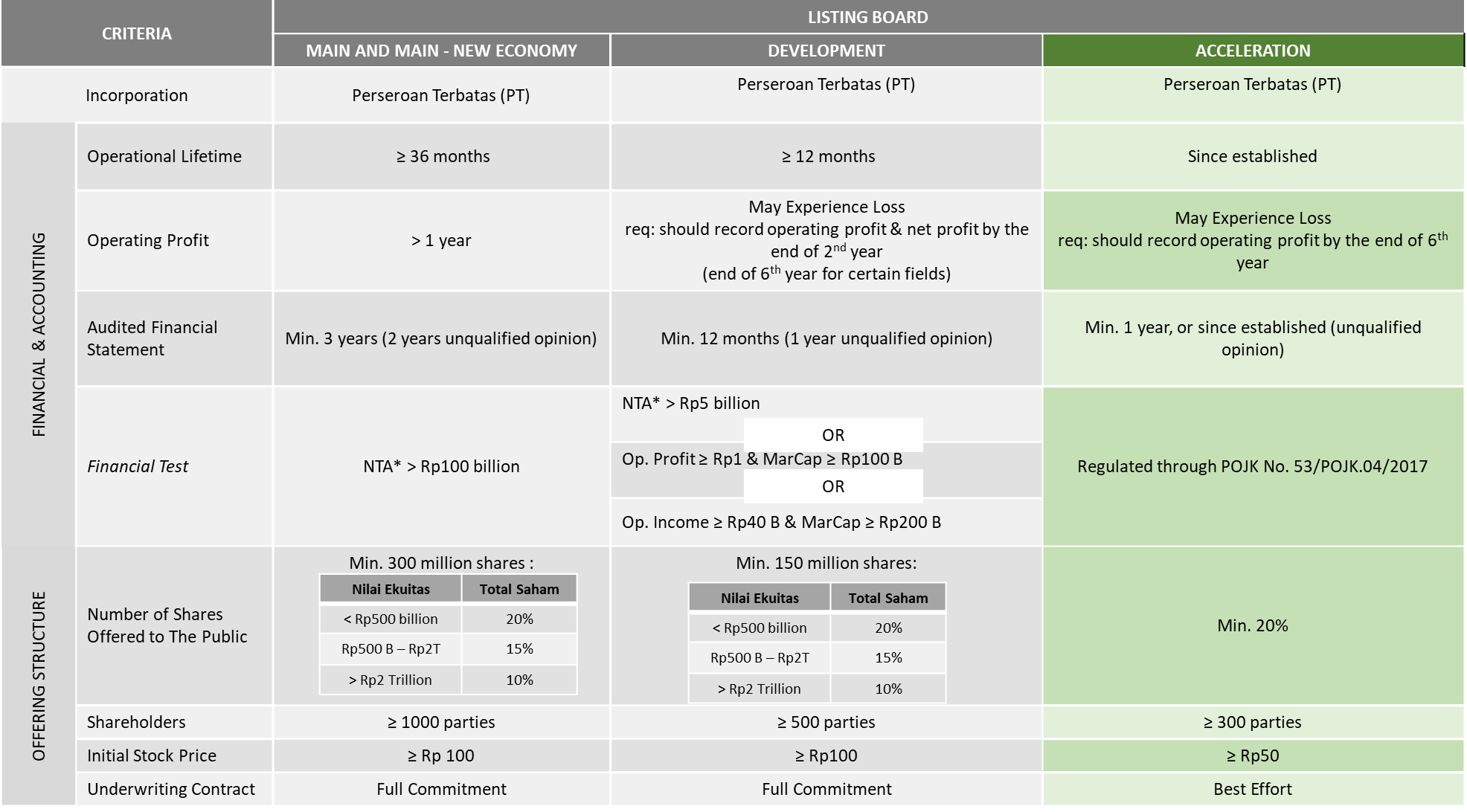

Potential listed company can be listed on Main and Main New Economy, Development, or Acceleration Board:

* Net Tangible Assets: Total Assets reduced by Intangible Assets, Deferred Tax Assets, Total Liabilities and Non-Controlling Interests

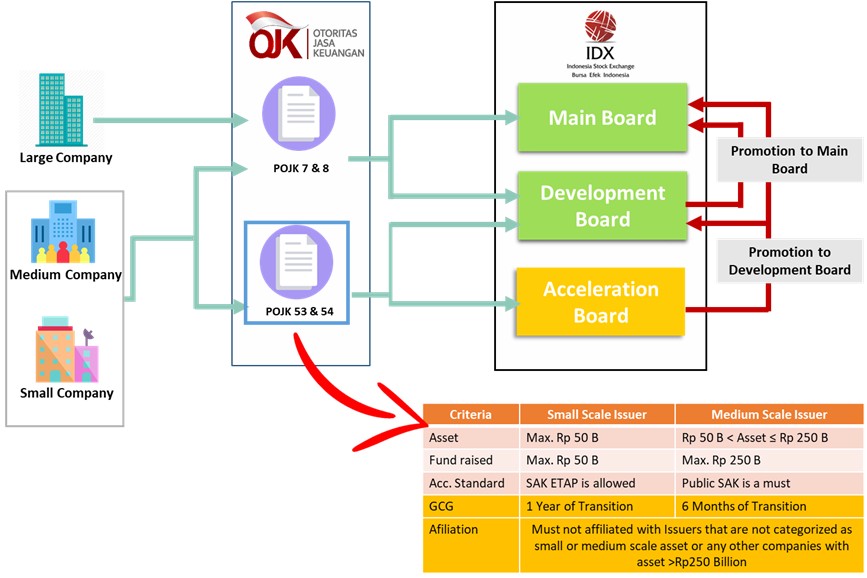

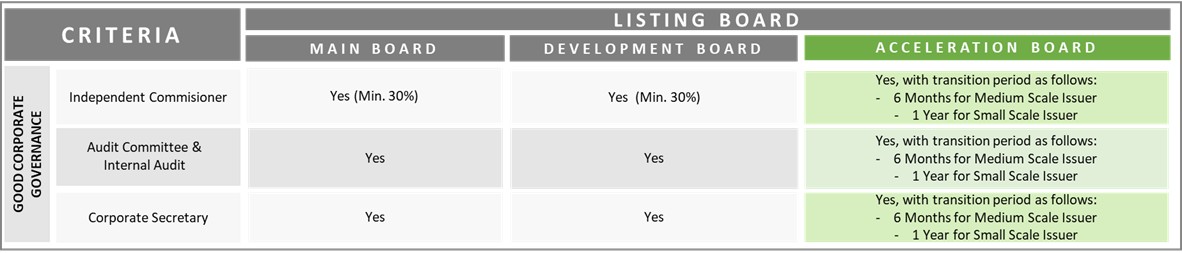

Acceleration Board

Acceleration Board is a Listing Board provided to accommodate issuers with Small-Medium Scale Assets as referred to OJK Regulation Number 53/POJK.04/2017 concerning Registration Statements for Public Offering and Capital Additions by Giving Pre-emptive Rights by Issuers with Small-Scale Assets or Issuers with Medium-Scale Assets. Companies which has not been able to meet the requirements of Development Board also can be listed on this board. The Acceleration Board Registration Regulation imposed by the IDX on July 22nd 2019.

Background

1. Establishment of OJK Regulations Related to Public Offering for Issuers with Small or Medium Scale Assets

On 2017, OJK has enacted POJK Number 53/POJK.04/2017 concerning Registration Statements for Public Offering and Capital Additions by Giving Pre-emptive Rights by Issuers with Small-Scale Assets or Issuers with Medium-Scale Assets.

2. Characteristics of Companies with Small and Medium Scale Assets

Companies with Small and Medium Scale Assets have their own characteristics, so they need to be specifically regulated both from the aspect of requirements, obligations and sanctions.

Target of Listed Companies on the Acceleration Board

Target of listed companies on the acceleration board are companies with small or medium scale assets which the categorization is regulated on POJK Number 53/POJK.04/2017

Benefits

The benefits of Acceleration Board are as follows:

Listing Mechanism

Listing Terms and Conditions

In addition to the Main Board and Development Board, currently the prospective listed company can be listed on the Acceleration Board. Here are some of the leniencies on the Acceleration Board compared to the Main Board and Development Board.

* Net Tangible Assets: Total Assets reduced by Intangible Assets, Deferred Tax Assets, Total Liabilities and Non-Controlling Interests

Other requirements that must be fulfilled by Listed Companies which are regulated through OJK Regulations

Listing Fees

Indonesia Stock Exchange sets a lower listing fee for listing on the Acceleration Board:

Movement on Boards

Listed company on the Acceleration Board can be promoted to the Development Board or Main Board at the consideration of the Exchange, when:

- Already in compliance with Listing requirements of the Development Board or Main Board and;

- No longer in compliance with the criteria of small or medium scale assets companies according to POJK 53.

New Economy Board

New Economy Board is a Listing Board provided to list shares of Companies that use technology to create product and/or service innovations that increase productivity and economic growth as well as have social benefits and have high growth rate. Regulated in Regulation I-Y concerning Listing of Shares and Equity Securities Other than Shares Issued by Listed Companies on the New Economy Board.

The objectives of New Economy Board are:

- To accommodate the companies with large market capitalization but have unique characteristics;

- Issuance of OJK Regulation Number 22/POJK.04/2021 concerning the Application of Classification of Shares with Multiple Voting Rights by Issuers with Innovation and High Growth Rates Conducting Public Offerings of Equity Securities in the Form of Share; and

- To support investor awareness in investing in particular company shares that have unique characteristics.

Companies in New Economy Board must meet unique characteristics as follows:

- High revenue growth;

- Use technology to create innovative products or services that increase productivity and economic growth and have broad social benefits; and

- Companies in a business field determined by Exchange.

Companies that meet certain characteristics as mentioned above can be listed in the New Economy Board.

New Economy Board Equivalences and Differences with the Main Board

New Economy Board has listing requirements that are equivalent to the listing requirements on the Main Board as stipulated in Regulation I-A concerning Listing of Shares and Equity Securities. If the Prospective Listed Company meets the requirements for listing on the Main Board, and meets certain characteristic criteria, the Exchange will list the Company on the New Economy Board.

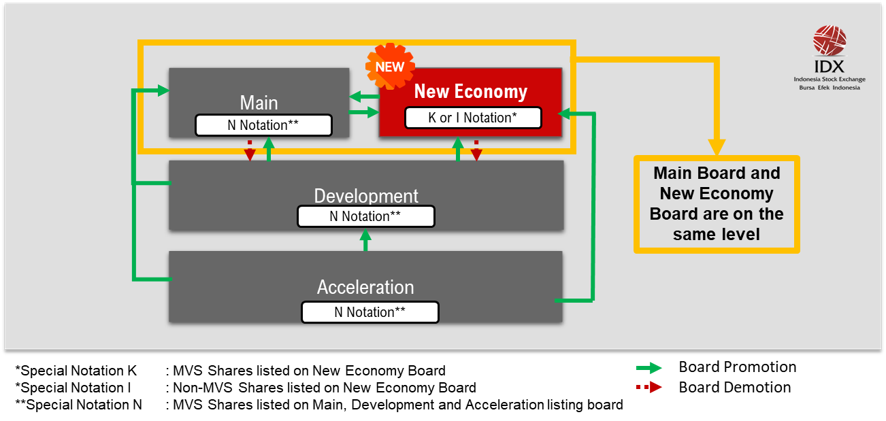

The positions of the New Economy Board with other Listing Boards are as follows:

The provision of this new economy board serves as a form of encouragement by the Exchange for supporting the development of companies that utilize technology and the digital economy, and as a means of branding for Listed Companies. In addition, the New Economy Board provides listing board segmentation on the Indonesia Stock Exchange, thus providing investment strategy tools for Investors.

Apart from providing listing board segmentation, the Exchange will also introduce a notation for companies listed on the New Economy Board, which indicates that the company is included in the new economy listing board and/or a company implementing Shares with Multiple Voting Rights (MVS), with detailed notation as follows:

|

Notation |

Description |

|

K |

Listed Company that implements Multiple Voting Shares and listed on New Economy Board |

|

I |

Listed Company that doesn’t implement Multiple Voting Shares and listed on New Economy Board |

|

N |

Listed Company that implements Multiple Voting Shares and listed on Main Board or Development Board |

Stocks with Multiple Voting at Glance

Multiple Voting Shares (MVS) is a classification of shares in which 1 (one) share grants more than 1 (one) voting rights to shareholders who meet the requirements. Parties who can own SHSM are included in the prospectus which will be submitted when the company will list its shares on the Exchange. The maximum SHSM voting rights can be up to 1: 40. This is regulated in more detail in the Financial Services Authority Regulation Number 22/POJK/04/2021 concerning the Application of Classification of Shares with Multiple Voting Rights by Issuers with Innovation and High Growth Rates Conducting Public Offerings. Equity Securities in the Form of Shares.

- To accommodate listing of companies with large market capitalization with unique characteristics.

- Issuance of OJK Regulation Number 22/POJK.04/2021 concerning Classification Application of Multiple Voting Shares by Issuers with Innovation and High Growth Rates Conducting Initial Public Offering.

- To raise investor awareness to shares of companies with unique characteristics.

New Economy Business Field

Business fields determined by Exchange are:

- Autonomous technology and industrial;

- Genomic and/or biomedicine;

- Fintech;

- Next generation internet (5G);

- Cloud computing and big data;

- Cyber security;

- Future cars;

- Video gaming; and

- Other business fields determined by Exchange.

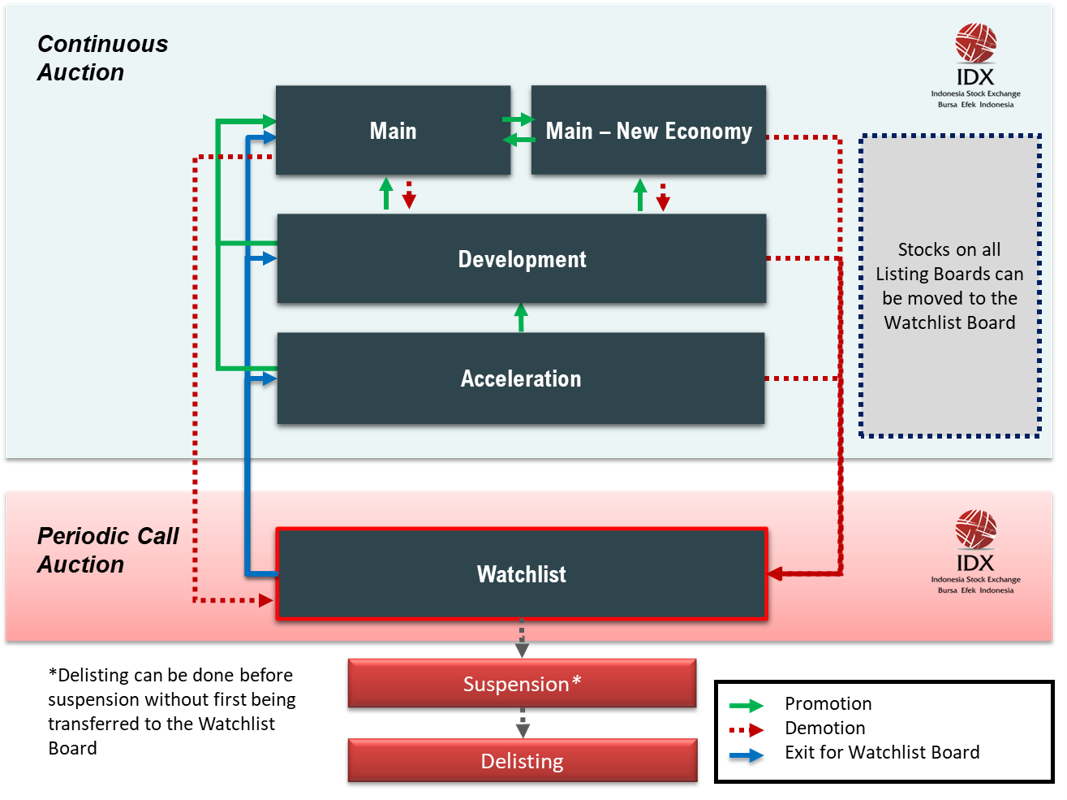

Watchlist Board

Watchlist Board is a Listing Board segmentation for stocks that have specific characteristics or falls under certain criteria, as stipulated on Exchange rule number I-X regarding Listing Placement for Securities on Watchlist Board.

The basis and objectives behind implementation of Watchlist Board:

- The Listed Company's condition may change and become inconsistent with its Listing Board's segmentation, certain conditions that are being experienced by a Listed Company may also impact the investment portfolio owned by the investors as well as trading activities and the formation of the Listed Company's share price.

- Stocks that are illiquid may also impact investors' investment strategies or may also hinder transactions activities of the Investor.

Watchlist Board is aimed to provide aa opportunity for investors to implement their investment strategy and also increase the stocks trading liquidity. Meanwhile improving protection for investors.

Benefits

For Investor

- Improving investor protection by grouping stocks that are subjected to the certain conditions into a separate listing board.

- Increasing transparency regarding the condition of listed companies.

- Reducing the formation of unreasonable share prices through periodic call auction trading which is more suitable for stocks with certain conditions and or illiquid, which has also been implemented by other stock exchanges in other countries.

- Support the price discovery mechanism for stocks under certain conditions.

- Providing opportunities for institutional investors to transact stocks which are trading at ≤ Rp50.00 in the regular market while still complying with governance.

For Listed Company

- Increase the liquidity of stock transactions.

- Providing a mean for the Listed Company in observing the Company's performance.

- Provide sufficient time for the Listed Company to improve its performance before its shares are subject to trade suspension.

Securities Criteria on Watchlist Board

- Average price of stocks in the Regular Market is less than Rp51.00 (fifty-one rupiah); and has low liquidity with the daily average transaction value of shares less than Rp5,000,000.00 (five million rupiahs) and the daily average transaction volume of shares is less than 10,000 (ten thousand) shares for the last 3 (three) months;

- Latest Audited Financial Statements receives a disclaimer opinion;

- No sales/income or there is no change in income based on the latest financial statements compared to previous financial statements.

- For listed companies which:

- Operates in the mineral and coal mining business which has carried out the production operation stage but has not entered into sales stage or has not started the production operation stage; or

- is the parent company that has a controlling interest of a company that operates in the mineral and coal mining business which has carried out the production operation stage but has not entered into sales stage or has not started the production operation stage at the end of the 4th (fourth) fiscal year book since being listed on the Exchange has not received any income from its main business activities (core business).

- Has negative equity in the last financial report;

- Does not meet the continuous listing obligation in accordance to:

- Rule number I-A concerning Listing of Shares (Stock) and Equity-Type Securities Other Than Stock Issued by the Listed Company, for Company which listed in Main or Development Board, except meet with free float provision at least 50,000,000 (fifty millions) for Main Board and Development Board and more than 5% (five percent) of total listed stocks; or

- Rule number I-V concerning Special Provision for Listing of Shares (Stock) and Equity-Type Securities Other Than Stock in Acceleration Board, For Company which listed in Acceleration Board, except meet with free float provision more than 5% (five percent) of total listed stocks;

- Has low liquidity with the daily average transaction value of shares less than Rp5,000,000.00 (five million rupiahs) and the daily average transaction volume of shares is less than 10,000 (ten thousand) shares during the last 3 (three) months in the Regular Market and/or Reguler Periodic Call Auction;

- Under a condition in which the company has a Postponement of Debt Payment Obligations (PKPU), filed for bankruptcy, or homologation cancellation;

- Has a subsidiary company in which the income contribution is material for the Listed Company and the subsidiary company has a Postponement of Debt Payment Obligations (PKPU), or filed for bankruptcy, or homologation cancellation;

- Subject to temporary suspension of Securities trading for more than 1 (one) Exchange Day which was caused by trading activities; or

- Other conditions stipulated by the Exchange after obtaining approval or order from Financial Services Authority.

Listed Company Provisions to Delisted from Watchlist Board

Listed Companies may Delisted from Watchlist Board with the following conditions:

- No longer in the condition referred to Securities Criteria on Watchlist Board number 2, 3, 5, 8, and 9;

- Have revenue based on the latest financial statements for the Listed Company in the condition as referred to Securities Criteria on Watchlist Board number 4;

- For Price and Liquidity on Criteria 1 already meet:

- No longer in the condition referred to Securities Criteria on Watchlist Board number 1; or

- Have distributed cash Dividend based on General Meeting of Shareholders (GMS);

- For Listed Criteria (fee float) on Criteria already meet:

- No longer in the condition referred to Securities Criteria on Watchlist Board number 6; or

- Registered in list of Liquidity Provider Securities and have Stock Liquidity Provider;

- For Listed Criteria (fee float) on Criteria already meet:

- No longer in the condition referred to Securities Criteria on Watchlist Board number 7; or

- Registered in list of Liquidity Provider Securities and have Stock Liquidity Provider;

- Have been on Watchlist Board for 7 (seven) Exchange Day for Listed Companies in the condition referred to Securities Criteria on Watchlist Board number 10;

- No longer in any other condition as referred to Securities Criteria on Watchlist Board number 11; and

- The Listed Company's stock price is at least Rp50,00 (fifty Rupiah), except for stock previously listed on the Acceleration Board.

If the Listed Company fails to meet all of the aforementioned provisions, it shall continue to remain on the Special Monitoring Board with the previously outlined criteria.

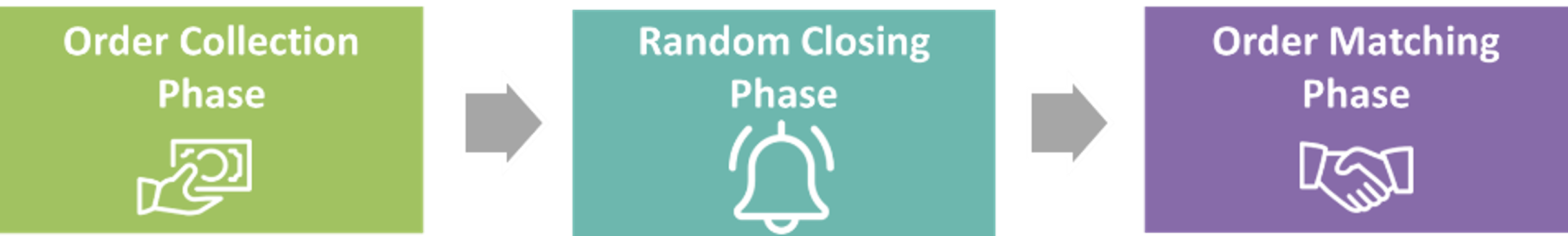

Trading Mechanism

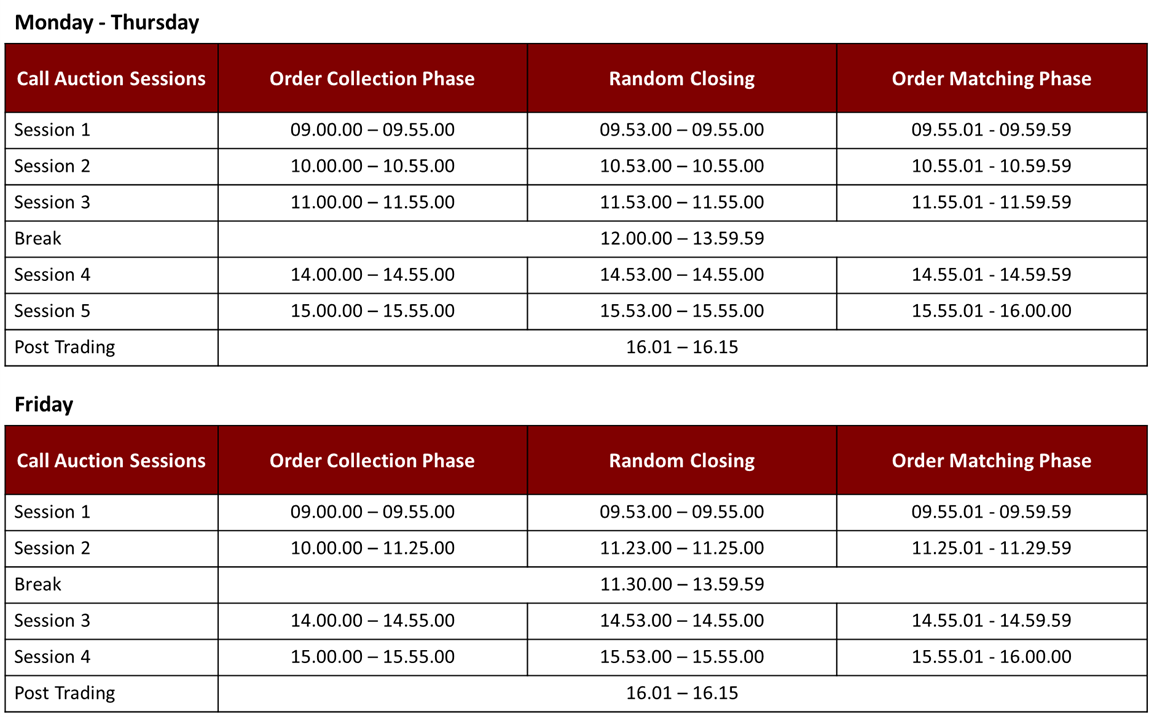

Stocks on Watchlist Board are traded using periodic call auction mechanism. In periodic call auction, orders are collected during Order Collecting Phase to Random Closing Phase. Orders will then be matched on Order Matching Phase at the end of each session.

Trading time:

Periodic call auction is the designated trading mechanism for Watchlist board, considering:

- More suitable for stocks with less trade frequency, so that price discovery will be improve.

- Reduce trading volatility and market sensitivity to extreme price.

- Is a preferred trading mechanism by many Exchanges, for stocks with low liquidity and under monitoring stocks.

Periodic call auction for stocks on Watchlist Board is implemented with transition phases, in order to help with market and investor adaptation. The phases are:

|

Watchlist Full Call Auction |

|

|

Trading Mechanism |

Periodic Call Auction |

|

Minimum Price |

IDR1 |

|

Auto Rejection (AR) |

|

|

Maximum Price Movement |

Not Apply |

Special Notation

Special Notation is an additional letter (notation) given to Listed Company ticker code when the company meet certain conditions as referred to in Circular Letter Number SE-00017/BEI/07-2021 concerning Addition of Information Display of Special Notation to the Listed Company Code.

Listed Companies whose stocks are on Watchlist Board will have special notation “X” (eXtra Caution) on the Listed Company ticker code.