Exchange-Traded Fund (ETF)

An ETF provides investors with exposure to a diversified basket of shares or other financial products. ETFs aim to replicate the performance of a specific index; this index can be a blue chip, a regional, or a sector index. ETF is similar with mutual funds, but we can trade ETF in Stock Exchange.

General Information

The differences between ETF and mutual funds:

| Stock Mutual Fund | ETF | |

|---|---|---|

| Trading | Investment Manager and Mutual Fund sales agent |

|

| Minimum Purchase | 1 unit | Primary Market: Creation unit ( = 1000 lot = 100.000 units) Secondary Market: 1 Lot (100 units) |

| Transaction fee | Buy and Sell fees (usually 1% until 3%) | Broker fee (same like stocks) in Stock Exchange |

| Price | The end of the day | Real time |

| Underlying | Stock | Reference index |

| Settlement | T+7 Settlement | T+2 Settlement |

| Dealer Participant | No | Yes |

Dealer Participant is Exchange's member who cooperate with ETF Investment Manager to sell and buy ETF shares. In Indonesia, there is 9 (nine) Dealer Participant, that is:

|

No |

Code |

Exchange Members' Name |

|

1 |

PD |

Indo Premier Sekuritas |

|

2 |

DH |

Sinarmas Sekuritas |

|

3 |

CC |

Mandiri Sekuritas |

|

4 |

DX |

Bahana Sekuritas |

|

5 |

KK |

Phillip Sekuritas Indonesia |

|

6 |

YP |

Mirae Asset Sekuritas Indonesia |

|

7 |

GR |

Panin Sekuritas Tbk |

|

8 |

BQ |

Korea Investment and Sekuritas Indonesia |

|

9 |

SQ |

BCA Sekuritas |

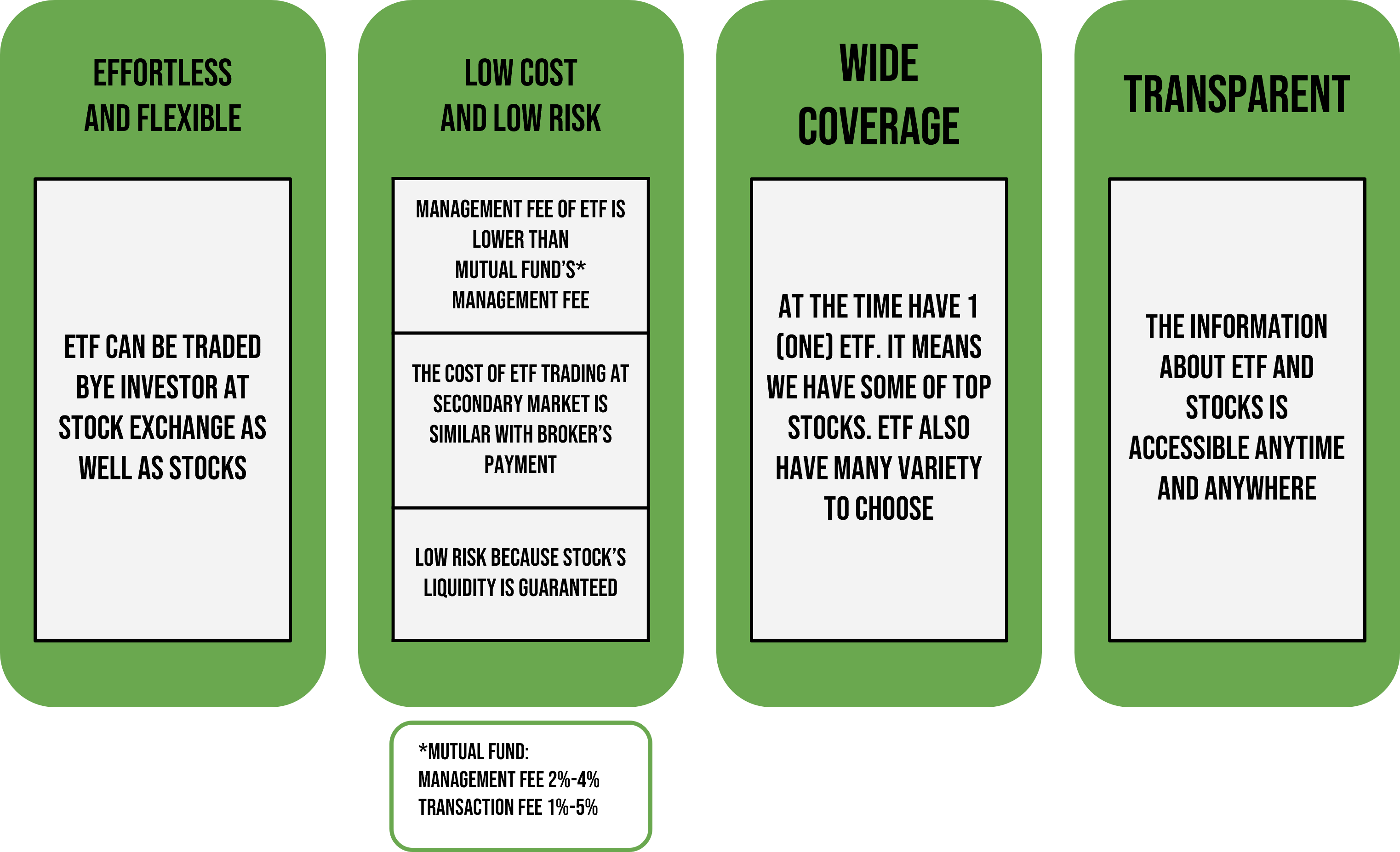

The Benefits of ETF

The benefits of ETF compare to another alternative investment are:

The Purpose of ETF

The purpose of trading ETF are:

- Diversification: Automatic Diversification of some superior stock in one order.

- Flexibility: Memanfaatkan fleksibilitas jual/beli yang tinggi, karena dapat langsung melakukan pembelian maupun penjualan ETF selama jam bursa berlangsung selayaknya saham.

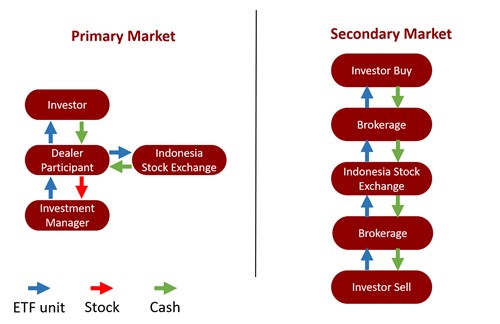

ETF's Trading Mechanism

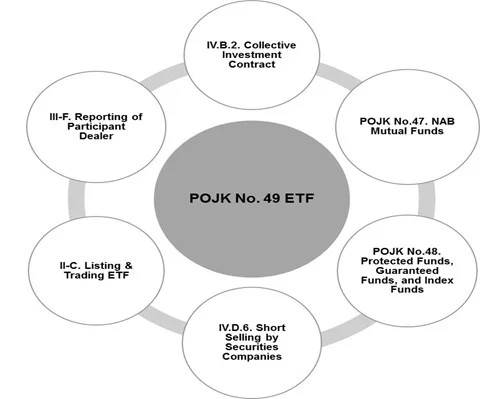

ETF’s Regulation

The surveillance of ETF is held by three parties, that is OJK, BEI and KSEI. ETF’s trading in Indonesia is regulated by :

Indicative Net Asset Value (iNAV)

Indicative Net Asset Value (iNAV) is a measurement of intraday NAV of an ETF and reflects the current market value of all assets in an ETF’s portfolio basket. The iNAV is published on IDX website during the exchange trading hours, and can be used as a simple reference of the fair value of an ETF at that time. The availability of iNAV information on IDX website can further highlight the transparency aspect of an ETF, in addition to the publication of ETF Portfolio Composition File (PCF) which can also be accessed by investors on IDX Website.

The iNAV displayed on IDX Website is calculated based on the information on the Portfolio Composition File (PCF) submitted by ETF issuer to IDX, and the current price of the underlying shares of an ETF, without taking into account regarding the liability aspects of an ETF (fees and costs). The calculation methodology of the iNAV is as follows:

Currently, IDX only calculate the iNAV of equity-based ETF.