Trading Hours and Mechanism

TRADING HOURS

In accordance with Decree of the Board of Directors of PT Bursa Efek Indonesia Number II-A Kep-00196/BEI/12-2024 Regarding Rule Number II-A concerning Trading of Equity Securities, PT Bursa Efek Indonesia stipulates changes in Exchange Trading Hours to be as follows:

Securities trading shall be conducted during the Trading Hours on every Exchange Day referring to the JATS time.

Trading Hours at the Regular Market

|

Session |

Day |

Time |

Type |

|

Pre opening (Input) |

Monday - Friday |

08.45.00 – 08.57.59 |

Shares on the Main Board, Development Board, and New Economy Board |

|

Non-Cancellation Period* (No Withdraw) |

08.56.00 – 08.57.59 |

||

|

Non-Cancellation Period* (No Amend) |

08.56.00 – 08.59.59 |

||

|

Pre opening( Matching) |

08.58.00 – 08.59.59 |

||

|

Session I |

Monday - Thursday |

09.00.00 – 12.00.00 |

All |

|

Friday |

09.00.00 – 11.30.00 |

||

|

Session II |

Monday - Thursday |

13.30.00 – 15.49.59 |

All |

|

Friday |

14.00.00 – 15.49.59 |

||

|

Pre closing (Input) |

Monday - Friday |

15.50.00 – 15.59.59 |

All |

|

Random Closing |

Monday - Friday |

15.58.00 – 15.59.59 |

All |

|

Non-Cancellation Period* (No Withdraw) |

Monday - Friday |

15.56.00 – 15.59.59 |

All |

|

Non-Cancellation Period* (No Amend) |

15.56.00 – 16.01.59 |

||

|

Pre closing (Matching Time) |

Monday - Friday |

16.00.00 – 16.01.59 |

All |

|

Post closing |

Monday - Friday |

16.02.00 – 16.15.00 |

All |

*will be enforced in 2025

Equity Trading Hours at the Cash Market

|

Session |

Time |

Time |

|

1st Session |

09.00.00 – 12.00.00 |

09.00.00 – 11.30.00 |

Equity Trading Hours at Negotiated Market

|

Session |

Time |

Time |

|

1st Session |

09.00.00 – 12.00.00 |

09.00.00 – 11.30.00 |

|

2nd Session |

13.30.00 – 16.30.00 |

14.00.00 – 16.30.00 |

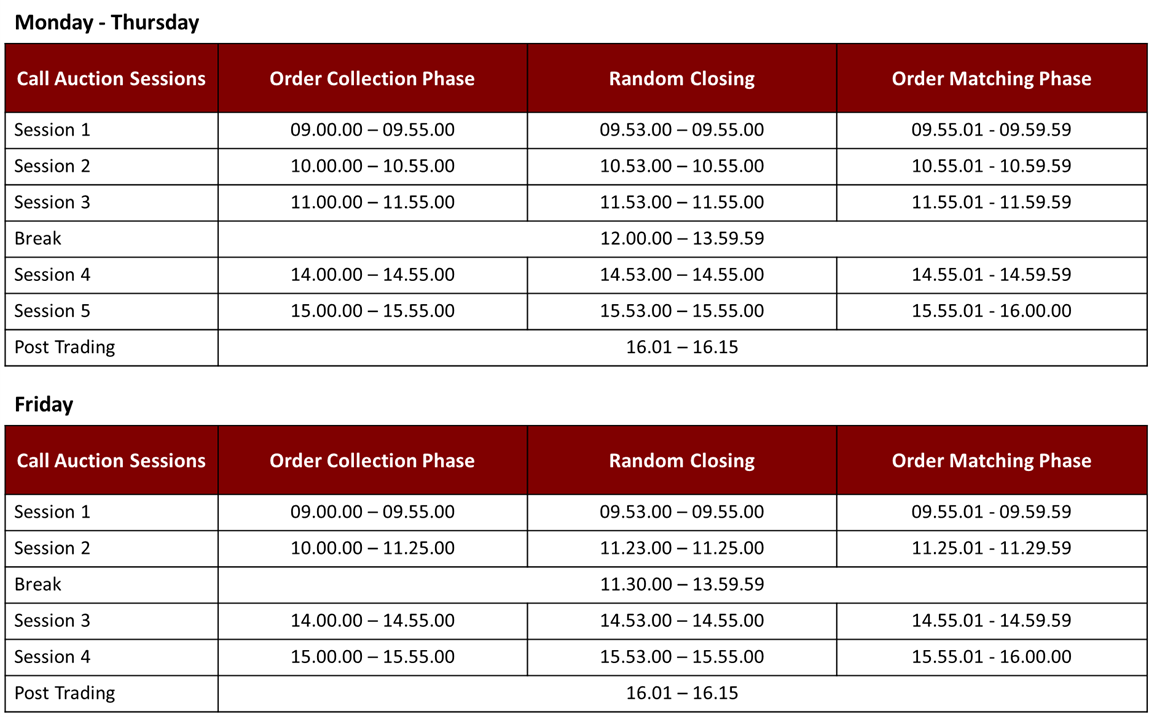

Trading Hours of Watchlist Full Call Auction

In accordance with Decree of the Board of Directors of PT Bursa Efek Indonesia Number: Kep-00316/BEI/11-2023 regarding Rule Number II-X concerning the Trading of Equity Securities on Watchlist Board, PT Bursa Efek Indonesia stipulates changes in Exchange Trading Hours to be as follows:

Trading Hours of Derivatives - Futures

In accordance with Decree of the Board of Directors of PT Bursa Efek Indonesia Number: Kep-00056/BEI/03-2023 regarding Rule Number II-E concerning the Trading of Futures Contract, PT Bursa Efek Indonesia stipulates changes in Exchange Trading Hours to be as follows:

|

Session |

Time |

Time |

|

1st Session |

08.45.00 – 12.00.00 |

08.45.00 – 11.30.00 |

|

2nd Session |

13.30.00 – 16.15.00 |

14.00.00 – 16.15.00 |

Debt and Sukuk Securities Trading Hour on Alternative Market Trading System (SPPA)

Monday to Friday

Starts from 09:00 to 16:00:00, SPPA Time

Securities Transaction Reporting Hour on Trade Repository Reporting System (PLTE)

Monday to Friday

Starts from 09:30 to 17:00:00, PLTE time

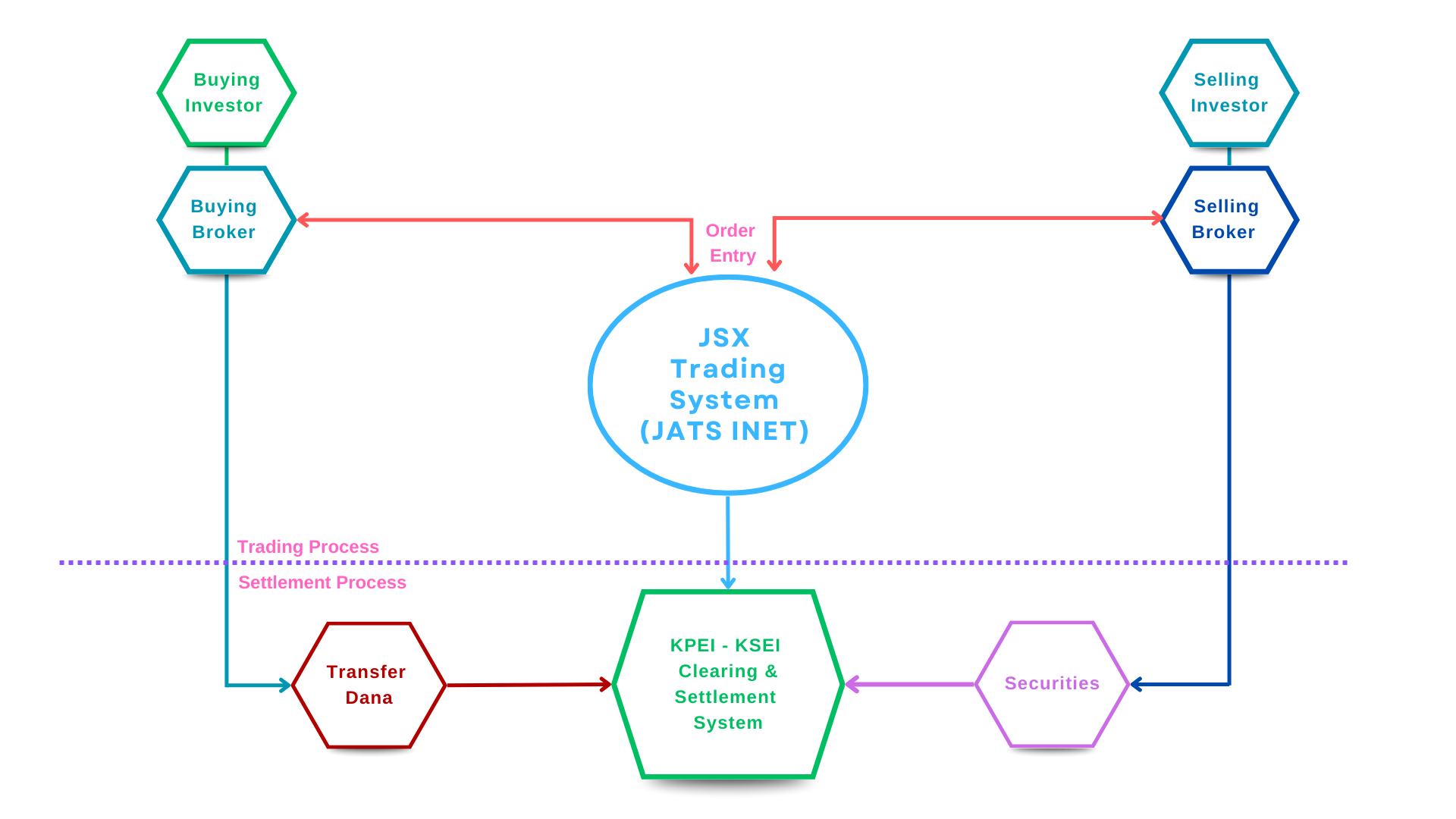

Equities Trading Mechanism

All transactions in the Exchange are processed in a facility called as JATS INET. Only the Exchange Members, who also become the members of the Indonesian Clearing and Guarantee Corporation (KPEI), can input the orders into the JATS. The Exchange Members are responsible for every transaction they make in the Exchange.

Trading Process in The Exchange

Transaction

Market Segmentation and Settlement

|

Market Segmentation |

Transaction Settlement |

|

Regular Market |

The second Exchange day after the trade is executed (T+2) |

|

Cash Market |

The same day as the trade (T+0) |

|

Negotiated Market |

Based on the agreement between the Seller and the Buyer |

Pre-Emptive Rights are traded only on the first session of the Cash and Negotiated Market.

Non-cancellation Period

Non-cancellation Period is a specific period during the pre-opening and pre-closing sessions in which orders that have been submitted cannpt be amend and/or withdrawn, however new sell/buy order can still be entered.

Here is the detail of the Non-cancellation Period:

1. Pre-opening session:

|

Non-Cancellation Period |

Day |

Time |

Mechanism |

|

Monday - Friday |

08.56.00 – 08.59.59 |

Can not amend Sell and/or Buy Open Orders |

|

|

08.56.00 – 08.57.59 |

Can not withdraw and/or amend Sell and/or Buy Open Orders |

2. Pre-closing session:

|

Non-Cancellation Period |

Day |

Time |

Mechanism |

|

Monday - Friday |

15.56.00 – 16.01.59 |

Can not amend Sell and/or Buy Open Orders |

|

|

15.56.00 – 15.59.59 |

Can not withdraw and/or amend Sell and/or Buy Open Orders |

Pre-Opening Session

Stock trading at the Regular Market starts with a Pre-opening session. This session allows Exchange Members to input their purchase and sell orders according to the provisions of the stock unit, step value and Auto Rejection limit. The Pre-opening price is formed from the accumulation of the total highest bids and asks matched by the JATS INET during the Pre-opening session. All bids and asks that have not been matched during the pre-opening session will be processed in the first session of the trading day, except if the price of the bids and asks has excel the Auto Rejection limit.

Pre-Closing and Post-Trading

At Pre-Closing Session, The Exchange Members may enter sell offers and/or buy requests by following the provisions about trading unit, price fluctuation unit (price fraction), and auto rejection. JATS forms the Closing Price and matches sell offers with buy requests at the Closing Price based on price and time priority.

In the Post-Trading, Exchange Members enter sell offers and/or buy requests at the Closing Price, and JATS continuously matches sell offers with buy requests, fully or partially, at the Closing Price based on time priority.

Regular Market and Cash Market

Bids and Asks will be processed by JATS INET by considering:

- Price Priority: Higher bids have more priority than lower bids. On the contrary, lower asks have more priority than higher asks.

- Time Priority: If the bids and asks are on the same price, JATS will give priority to the first submitted bids and asks.

Reduction on the number of purchase or sell order processed into the JATS will not cause time priority lose.

Negotiated Market

In Negotiated Market, prices of each security are bargained out between:

- Exchange Members

- Investor and one Exchange Member

- Investor and Exchange Members

The results of the negotiation will be processed through the JATS INET. The Exchange Members can submit their bids and asks through the ad board, and they can change or cancel them before they are matched with other bids and asks in the JATS INET. Once they are matched, a transaction is made and will be carried out.

Trading Unit

Stock Trading at Regular and Cash Market must be traded according to stock unit, that is round lot, which 1 lot = 100 shares. Detail information regarding the Price Fraction can be found in the IDX Regulation number II-A Kep-00196/BEI/12-2024.

|

Price Fraction Scale |

Price Fraction |

Maximum Price Movement* |

|

<200,- |

Rp1,- |

Rp10,- |

|

Rp200,- < Rp500,- |

Rp2,- |

Rp20,- |

|

Rp500,- < Rp2.000,- |

Rp5,- |

Rp50,- |

|

Rp2.000,- < Rp5.000,- |

Rp10,- |

Rp100,- |

|

>= Rp5.000,- |

Rp25,- |

Rp250,- |

Stock step value and its maximum price step are valid for one entire trading day and will be adjusted on the next day if its closing price falls on a different price range. The maximum price step should not exceed the percentage of Auto Rejection limit.

Leveraged Transactions

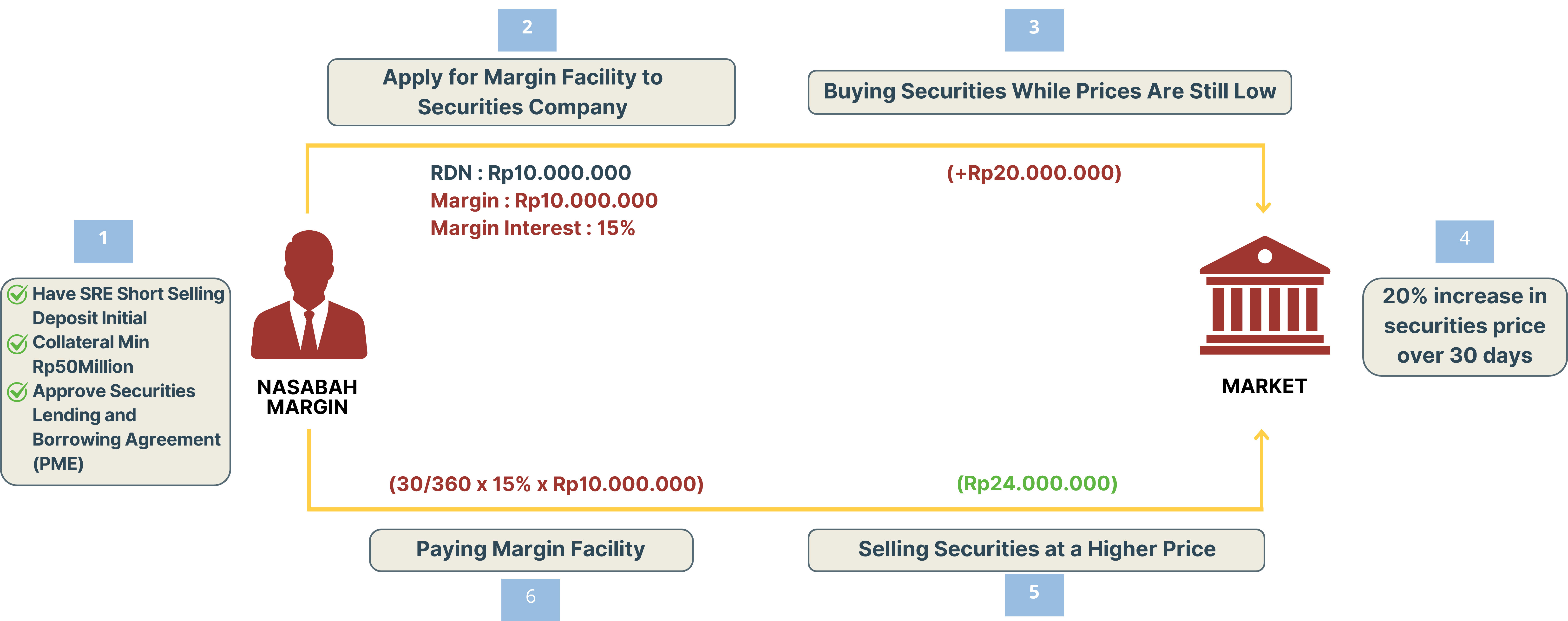

1. MARGIN TRANSACTION

Margin is a securities order buy transaction financed by a Securities Company. Margin transactions can only be conducted on securities that meet the requirements set by the Exchange.

To be included in the list of Securities eligible for Margin Transactions, the Securities must meet the following requirements:

|

Provision |

Period of listed stock on IDX |

|

|

> 12 Months |

≥ 3 – 12 Months |

|

|

Transaction Period |

At least 90% of the total number of trading days in the last six (6) months. |

Traded on at least 90% of the total number of Trading Days during:

|

|

Average Value or Volume Daily Transaction |

Last 6 months:

|

1. Average daily transaction value > Rp10,000,000,000 during: a. At least the last 3 months, for stocks that have been listed for less than 6 months on the Exchange; or b. The last 6 months, for stocks that have been listed for 6 months or more on the Exchange. Or 1. Average daily transaction value > Rp500,000,000 and average daily transaction volume > 1,000,000 shares during: a. At least the last 3 months, for stocks that have been listed for less than 6 months on the Exchange; or b. The last 6 months, for stocks that have been listed for 6 months or more on the Exchange. |

During the review period, marginable stocks were listed at:

- Main Board;

- Main New Economy Board; or

- Development Board or Acceleration Board following with provisions :

- Minimum 300 number of shareholders have Single Investor Identification (SID).

- Minumum 50.000.000 shares on free float and at least 7,5% from listed shares.

- Is not in net loss or negative equity condition based on Submitted latest financial statement.

- Fulfil these condition:

- PER Ratio is not 5 times more than PER Market and Positive PER;

- PBV Ratio is not 5 times more than PBV Market dan Positive PER; or

- PBV Value is not 5 times more than PBV Market and positive retained earning.

Margin stocks can be traded on the following markets:

- Reguler

- Cash

- Negotiation

*Exception: Not part of Syariah Listed Company.

Margin Transaction Illustration

The potential profit is gets from short shell transaction value minus the buy back transaction value, with the details as follows:

- Selling price and buy back price deviation: Rp24.000.000 – Rp20.000.000 = Rp4.000.000

- Securities Borrows fee for 20 Days: 30/360 x 15% X Rp10.000.000 = (Rp125.000)

- Selling Fee(0.1433%) : 0.1433% x Rp24.000.000 = (Rp34.392)

- Buying Fee(0.0433%): 0.0433% x Rp20.000.000 = (Rp8.660)

- Nett Profit: (Rp4.000.000 – Rp125.000 – Rp34.392 – Rp8660) = Rp3.831.948

*in this illustration, we assume that borrowing securities within 30 Days with 15% p.a. interest rates.

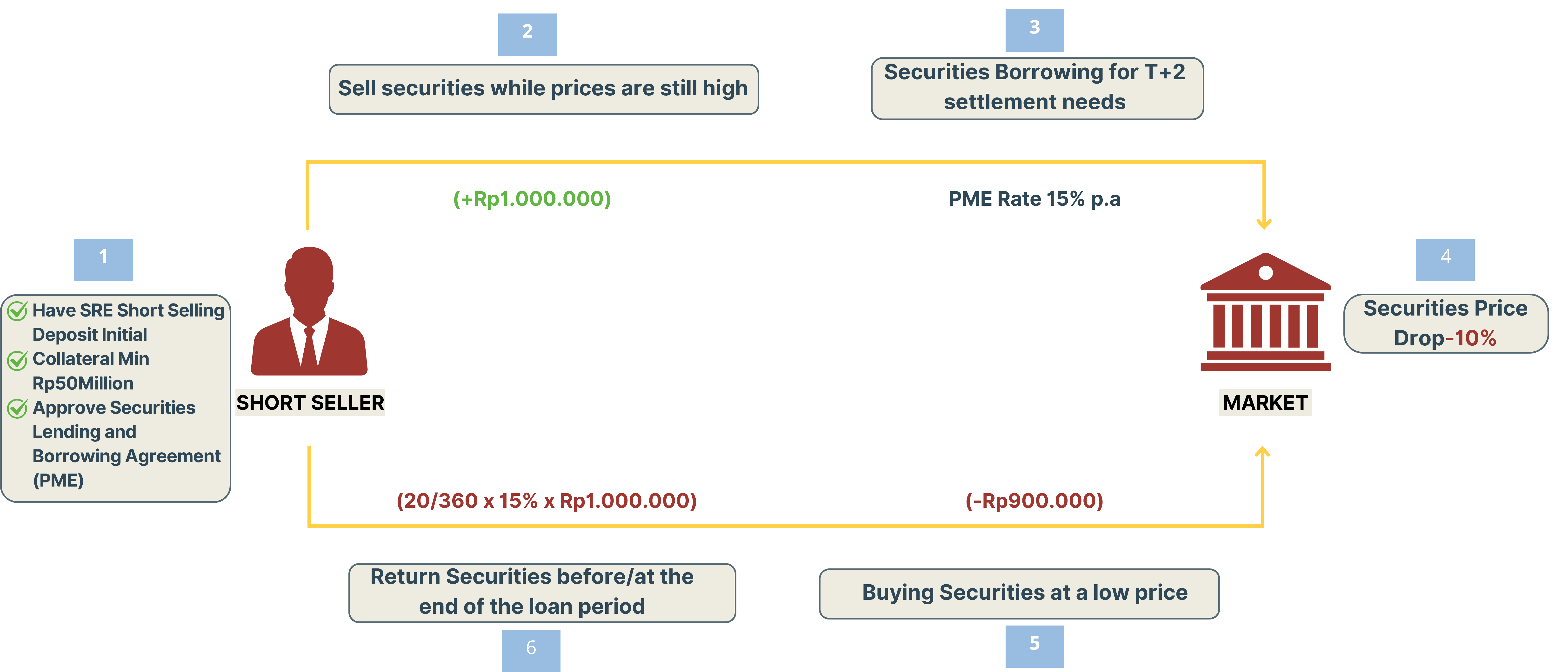

2. SHORT SELLING TRANSACTION

Short Selling is a trading mechanism to sell security when investor doesn’t have the security while trading.

Before start Short Selling, Investor must understand the rights and obligations related to Short Selling Transactions, have opened a short selling securities account and have signed a securities borrowing and lending agreement with a Securities Company.

Short Selling Transactions may only be carried out for Securities that are listed in the Short Selling Securities List, and the position settlement may take place on a different Exchange Day.

To be included in the Short Selling Securities List, the Securities must meet the following requirements:

|

Criteria |

Description |

|

Security Type |

Securities that eligible with Margin Criteria |

|

Free float |

At least 20% free float from evaluation period: 1. Last 6 months until next review period for stocks listed at least 6 moths or more; or 2. At least listed in last 3 months until next review period for stocks listed less than 6 months. |

|

Trading Market |

Except Negotiation Market |

Others provision on list of Securities of Margin and/or Short Selling:

- IDX has the authority to impose additional criteria within the approval of the Financial Service Authority (OJK).

- IDX has the authority to set others strict polices based on established criteria by considering market conditions and trading activities conducted by exchange members

- The Exchange determines the list of Margin and Short Selling securities and announces it to the public and report to Financial Services Authority no later than two trading days each month.

Short Selling Transaction Illustration

The potential profit is gets from short shell transaction value minus the buy back transaction value, with the details as follows:

- Selling price and buy back price deviation : Rp1.000.000 – Rp900.000 = Rp100.000

- Securities Borrows fee for 20 Days : 20/360 x 15% X Rp1.000.000 = (Rp8.333)

- Selling Fee(0.1433%) : 0.1433% x Rp1.000.000 = (Rp1.433)

- Buying Fee(0.0433%) : 0.0433% x Rp900.000 = (Rp390)

- Nett Profit : (Rp100.000 – Rp8.333 – Rp1.433 – Rp390) = Rp89.844

((Rp89.844/Rp1.000.000)x100) = 8,98% higher than short shell value

*in this illustration, we assume that borrowing securities within 20 Days with 15% p.a. interest rates

Disclaimer: Investors can only enter the selling price for Short Selling/Intraday Short Selling transactions at a minimum of the Last Done Price/Matched price in the trading session (at tick).

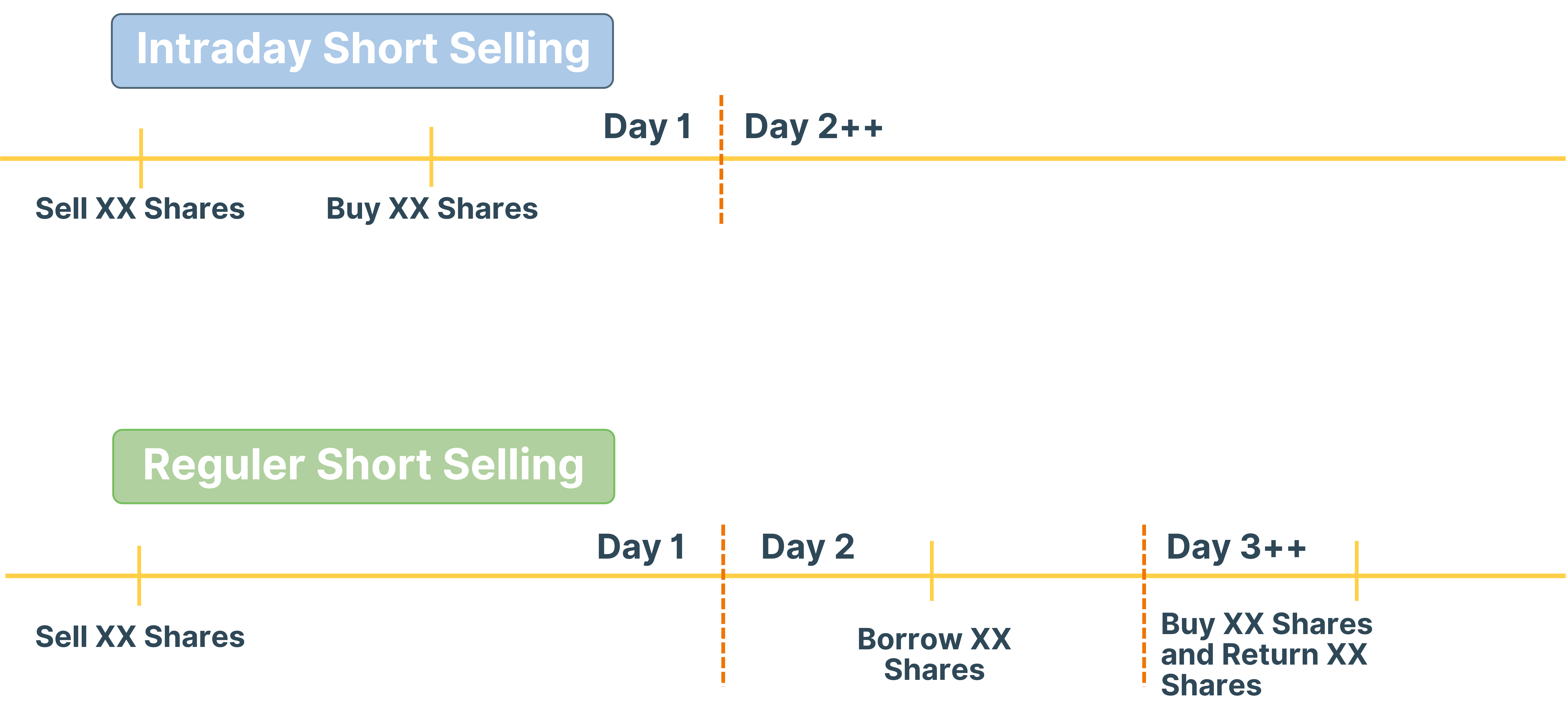

Intraday Short Selling

Intraday short selling is a short selling transaction where the settle position is on the same trading day (net off at the end of the trading day), where regular short selling allows the position to be settle on different trading days that require securities lending and borrowing activities.

Intraday Short Selling Transaction Illustration

The potential profit is gets from short shell transaction value minus the buy back transaction value, with the details as follows:

- Selling price and buy back price deviation: Rp1.000.000 – Rp900.000 = 000

- Selling Fee(0.1433%): 0.1433% x Rp1.000.000 = (Rp1.433)

- Buying Fee(0.0433%): 0.0433% x Rp900.000 = (Rp390)

- Nett Profit: (Rp100.000 – Rp1.433 – Rp390) = Rp98.177

((Rp98.177/Rp1.000.000)x100) = 9,81% higher than Short Sell value

Using the Intraday Short Selling (IDSS) mechanism, the potential profit earned by the investor in the illustration is 0.83% greater compared to the regular Short Selling scenario.

Disclaimer:

- Investors can only enter the selling price for Short Selling/Intraday Short Selling transactions at a minimum of the Last Done Price/Matched price in the trading session (at tick).

- Short Selling has the potential to generate greater profits than IDSS if market conditions cause the price of the transacted stock to continue declining over time., IDSS only captures the price decline exposure on the day the transaction is executed.

The Difference Between Short Selling dan Intraday Short Selling

|

Criteria |

Short Selling |

Intraday Short Selling (IDSS) |

|

Settlement Period |

Could be more than one Trading Day |

Must be on the same trading day |

|

Need Securities Landing and Borrowing (SBL) |

Yes |

No |

|

SBL Fee |

Yes |

No |

|

Market Risk |

Tends to be higher compared to IDSS, because the short selling position remains open for more than one Exchange Day |

It tends to be lower compared to regular short selling, because it potentially avoids exposure to market fluctuations on the following trading day |

Settlement (T+2) and Lending and Borrowing

Since the settlement of a short selling financing position can be conducted on a different day than the transaction itself, securities borrowing and lending (SBL) is required at the T+2 settlement date. In contrast, for Intraday Short Selling, where the position must be closed on the same day, SBL is not required at the T+2 settlement.

The financing settlement of a Short Selling Transaction can be fulfilled using:

- The investor’s own portfolio

- Securities borrowed from:

- The Clearing and Guarantee Institution;

- The Securities Financing Institution;

- Another Securities Company;

- A Custodian Bank; and/or

- Other parties.

Below this is the illustration short selling and vs intraday short selling transaction settlement:

Short Selling and/or Intraday Short Selling Transaction Tips:

- Open short selling account on Exchange Members that have short selling license.

- Minimum Initial Guarantee IDR50.000.000 or as determined by the exchange member.

- Trading analysis on short sell stock.

- Short shell price is same as last done price (at tick) or higher than at tick.

- Buyback at same trading days for intraday short selling.

- Periodically monitoring of the short selling transaction ratio, and ensure compliance with all obligations (e.g., transaction ratio limits, short selling margin top-ups, etc.).

Risks and Benefits of Short Selling

| Benefits |

|

| Risks |

|

TRADING PROVISIONS OF MARGIN AND SHORT SELLING SECURITIES

On Margin and/or Short Selling Securities transactions, Exchange members must fulfil the following conditions:

|

Provisions |

Margin |

Short Selling |

|

Additional Securities Account |

Yes |

Yes |

|

Initial Guarantee |

1. 50% of the Transaction Value (Margin/Short Selling); or 2. Rp50,000,000 (as per the initial collateral value required by the Exchange Member). |

|

|

Trading Market |

Reguler, Cash and Negotiation |

Reguler and Cash |

|

Exchange Members Type |

Margin Licensed Exchange Members |

Short Selling Licensed Exchange Members |

|

Transaction Order |

Specific margin sign when buy order |

Give a short selling sign when sell order |

|

Trading Price |

In addition to transactions on the Negotiated Market, the margin stock price limit is in accordance with the applicable Auto Rejection limit |

Trade on same price or higher than last done price (at tick/higher) |

Auto Rejection

The buying and selling price inputted into the JATS must be within a certain price range. If an Exchange Member inputs a price order above or below the stock's price range, the JATS will automatically reject the order.

Based on Decree of the Board of Director of PT Bursa Efek Indonesia Number II-A Kep-00196/BEI/12-2024 regarding Rule Number II-A concerning the Trading of Equity Securities, the percentage limit of auto rejection in the Regular and Cash Market effective as of Tuesday, April 8th, 2025, as follows:

| Equity | Price Range | Auto Rejection (AR) | ||

| Upper Limit Percentage of Auto Rejection (ARA) | Lower Limit Percentage of Auto Rejection (ARB) | Volume | ||

| Stock listed on the Main, New Economy, and Development Board | Rp50.00 - Rp200.00 | 35% | 15% |

>50.000 Lot or 5% of stock's listed shares |

| >Rp200,00 - Rp5,000.00 | 25% | 15% | ||

| > Rp5,000.00 | 20% | 15% | ||

| Stock listed on Acceleration and Watchlist Board | Rp1.00 - Rp10.00 | Rp1 | Rp1,00 | |

| >Rp10.00 | 10% | 10% | ||

| ETF and DIRE | Rp50.00 - Rp200.00 | 35% | 15% | |

| >Rp200.00 - Rp5,000.00 | 25% | 15% | ||

| > Rp5,000.00 | 20% | 15% | ||

| DINFRA | ≥Rp50.00 | 10% | 10% | |

| Right Issue | All | - | - | |

| Warrant | All | ≥Last traded price of underlying stock on reguler market | - | |

The implementation of Auto Rejection for Stock trading resulting from an initial public offering will be determined at 1 (one) times of the limit of auto rejection percentage as mentioned above.

For Warrants, Auto Rejection can be set as follows:

- First trading day:

Equal or exceed the last trading price of the shares underlying the Warrant - After the first day is recorded, the following smaller provisions will apply based on the conditions below:

- Equal to or greater than the last trading price of the underlying stock of the Warrant,

- Tiered auto rejection according to the Warrant price range, with the following details:

|

No. |

Price |

Limit |

|

1 |

Rp1.00 - Rp9.00 |

Rp10.00 |

|

2 |

Rp10.00 - Rp200.00 |

>50% |

|

3 |

>Rp200.00 – Rp5,000.00 |

>40% |

|

4 |

>Rp5,000.00 |

>30% |

The Reference Price used to set the upper and lower limit for the offering price of stocks traded in the Regular Market on JATS are determined based on:

- Previous price

- Theoretical price of corporate action result

- The initial price for the stock of a listed company that is traded on the Exchange for the first time; or

- The fair value of market determined by the business appraiser as referred to in the Financial Services Authority Regulation Number 35/POJK.04/2020 concerning Valuation and Presentation of Business Valuation Reports in the Capital Market.

INDICATIVE EQUILIBRIUM PRICE (IEP) & INDICATIVE EQUILIBRIUM VOLUME (IEV)

Indicative Equilibrium Price (IEP) is information of potential transaction prices that will be formed on pre-opening, pre-closing, and call auction sessions of watchlist board. Meanwhile, Indicative Equilibrium Volume (IEV) is information on the potential transaction volume that can be found at the price that will be formed/IEP.

The benefits of IEP and IEV are:

- Transparency of opening and closing prices formation in the blind orderbook

- Reduce the potential of marking the close

- Make it easier for market participants to execute transactions in the blind orderbook.

Trading sessions and share types with IEP and IEV information:

|

Session |

Day |

Time |

Share Types |

|

Pre-Opening |

Monday - Friday |

08.45.00 – 08.59.00 |

LQ45 Index Constituent |

|

Call Auction of |

Monday - Thursday |

09.00.00 – 11.54.59 |

Watchlist Board Stocks |

|

Friday |

09.00.00 – 11.24.59 |

||

|

Pre-closing |

Monday - Friday |

15.50.00 – 16.00.00 |

Exclude Watchlist Board Stocks |

MARKET ORDER

Market order is an order type of buy/sell share from an Exchange Member that has higher order price priority compared to other types of orders.

The benefits of Market Orders are:

- Facilitates order execution at market prices and in real time

- Increase the potential for transactions to be occurred.

- Has a higher Order Priority than Limit Orders on the JATS System

- Potentially match at the best price.

Market Order Type

|

Criteria |

FAK |

FOK |

MTL |

|

Match mechanism |

Matched in its entirety or in partially at various price levels available in Order book |

Matched in its entirety or not at all at various price levels available in Order book |

Matched in its entirety or partially at various price levels available in Order book |

|

Order Duration Type |

Immediate |

Immediate |

1. Session |

|

Trading Sessions |

1. Pre-Opening Session |

1. Session 1 |

1. Session 1 |

|

Sweep limit (price that can be matched) |

Maximum 10 price fractions after best bid for sell orders or best ask for buy orders |

Maximum 10 price fractions before being converted into a limit order after best bid for sell orders or best ask for buy orders |

|

|

Market Order can only be submitted if there is a best bid for sell orders or a best ask for buy orders in the order book |

|||

TRANSACTION SETTLEMENT

Regular and Cash Markets

Transaction settlements between the sellers and buyers in the Regular and Cash Markets are guaranteed by the KPEI.

- Transactions in Regular Market have to be settled on the third Exchange day after the trade (T+2).

- Transactions in Cash Market have to be settled on the same day as the trade (T+0).

- Settlement process in the Regular and Cash Market is carried out by the KPEI through the Netting process and book-entry on the Exchange Members' accounts in the Indonesian Central Securities Depository (KSEI).

If an Exchange Member fails to fulfill its obligations to deliver the securities as determined, it has to pay an Alternate Cash Settlement (ACS) amounted to 125% (one hundred twenty five percent) of that securities' highest price in:

- The Regular and Cash Market, which deadline of settlement falls on the same date; and

- The first session of the Regular Market at the settlement date.

Negotiated Market

The settlement date in the Negotiation Market is decided based on the agreement between the seller and buyer, and is settled Trade by Trade (without Netting). If the date has not yet been decided, the transaction settlement has to be settled on the third Exchange day after the trade (T+2) at the latest, or on the same day as the transaction (T+0), if the trade took place on the last day of pre-emptive rights trading.

The transaction settlements in Negotiated market sre settled by direct transfer accounts between the buyers and sellers and are not guaranteed by the KPEI.

Transaction Fees

For every transaction, the Exchange Members have to pay fees to the IDX, KPEI and KSEI based on the value of each transaction:

|

|

Regular Market |

Cash Market |

Negotiated Market |

| IDX Transaction Fee |

0.018% |

0.018% |

0.018% |

|

KPEI Clearing Fee |

0.009% |

0.009% |

0.009% |

|

KSEI Settlement Fee |

0.003% |

0.003% |

0.003% |

|

KPEI Guarantee Fee |

0.010% |

0.010% |

- |

|

VAT 12% |

0.0033% |

0.0033% |

0.0033% |

|

Final Withholding Tax 0.1% |

0.100% |

0.100% |

0.100% |

|

Total |

0.1433% (Sell) 0.0433% (Buy) |

0.1433% (Sell) 0.0433% (Buy) |

0.1333% (Sell) 0.0333% (Buy) |

*Paid to the Exchange as compulsory contribution, in accordance to the prevailing provisions.

Transaction Fee above is exclude Exchange Members transaction fee.

**Referring to PMK 131 of 2024, VAT Rate is calculated by multiplying Rate 12% of the Tax Base 11/12 of the Bill Amount.

Debt Securities and Sukuk Trading Mechanism

Secondary trading of Debt Securities and Sukuk (Efek Bersifat Utang dan Sukuk - EBUS) can be conducted through the Alternative Market Operator System (Sistem Penyelenggara Pasar Alternatif - SPPA). Debt Securities trading at SPPA can only be carried out between SPPA Users, both for their own interests and for the interests of their customers, with the obligation to follow the rules set by Alternative Market Operators (Penyelenggara Pasar Alternatif - PPA) and PPA Guidelines. SPPA Users can be Securities Companies, Banks, or other parties approved by the Financial Services Authority (Otoritas Jasa Keuangan - OJK).

Alternative Market Operator System (Sistem Penyelenggara Pasar Alternatif - SPPA)

The Alternative Market Operator System (Sistem Penyelenggara Pasar Alternatif - SPPA) is a trading platform for the secondary market for Debt Instruments provided by the Indonesia Stock Exchange for SPPA Users. Debt Securities and Sukuk (Efek Bersifat Utang dan Sukuk - EBUS) that can be traded through SPPA are EBUS included in the Alternative Market Operators (Penyelenggara Pasar Alternatif - PPA) Securities List.

There are 3 (three) trading mechanisms at SPPA, namely:

- Central Limit Order Book (CLOB) or Trading Board

In this trading mechanism, SPPA Users submit executable quotations to SPPA. The quote will appear on the Trading Board anonymously. SPPA Users who are interested can immediately confirm buy/sell (click to trade) on the quotes on the Trading Board.

- Request for Quotation (RFQ)

SPPA user may request a quote from all Counterparts that have a Limit with the SPPA User. The party receiving the RFQ request submits a price quote and can counter each other during the RFQ session. The RFQ process runs anonymously.

- Request for Order (RFO)

RFO can be used for direct negotiations between 2 (two) SPPA Users. The negotiation is conducted transparently. Both parties conducting an RFO can counter each other during an RFO session

Settlement Date at SPPA

|

Trading Mechanism |

Settlement Date |

|

Central Limit Order Book (CLOB) or Trading Board. |

T+2 |

|

Request for Quotation (RFQ) |

T+0 until T+7 |

|

Request for Order (RFO) |

T+0 until T+7 |

SPPA Trading Hours

|

Monday - Friday |

|

|

08:30 – 09.00 |

Pre Trade Session |

|

09:00 – 16.00 |

Trade Session |

|

16.00 |

Closing Session |

Transaction Fee at SPPA

Transaction fees through SPPA are charged on a percentage basis based on the total value of SPPA User Transactions for one month with the following details:|

Transaction Value per month |

Transaction Fee |

|

Up to IDR100 Billion |

0,0015% |

|

More than IDR100 Billion up to IDR500 Billion |

0,00125% |

|

More than IDR500 Billion |

0,001% |

Derivatives Trading Mechanism

Derivatives transactions in the Exchange are processed in a facility called as JATS INET. Only the Derivatives Exchange Members can input the orders into the JATS INET. The Exchange Members are responsible for every transaction they make in the Exchange.

Trading Process

There is two Derivatives which can be traded in IDX, that is LQ45 Index Futures and Indonesia Government Bond Futures (IGBF). The Exchange Members are responsible for every derivatives transaction they make in the Exchange. Derivatives Transaction in the Exchange are processed in a facility called as JATS INET. The trading method is Continous Auction form and the trading method is based on price and time priority. The Exchange Members can submit their bids and asks through the ad board, and they can change or cancel them before they are matched with other bids and asks in the JATS INET. Once they are matched, a transaction is made and will be carried out.

| Derivatives | Underlying | Contract Period |

| LQ45 Futures | LQ-45 index | 1 month, 2 months, 3 months |

| Indonesia Government Bond Futures (IGBF) | - 5-Year Benchmark Indonesia Government Bond Futures - 10-Year Benchmark Indonesia Government Bond Futures |

3 months in the March quarterly cycle (March, June, September and/or December) |

| IDX30 Futures | IDX30 Index | 1 Month, 2 Months dan 3 Months |

| Basket Bond Futures (BBF) | - Government Bond with maturities of 4 to less than 7 years - Government Bond with maturities of 7 to less than 11 years |

March, June, September, or December |

Liquidity Provider

In Derivatives Trading Mechanism, IDX introduced the new mechanism called Liquidity Provider. Derivatives Exchange Members who also act as Liquidity Provider can submit the quotation (bids and asks) continuously to make Derivatives transaction liquid.

Derivatives Trading

| Derivatives | Multiplier | Tick Size | Initial Margin |

| LQ45 Futures | Rp500.000 | 0.05 Point Index | 4% * index point * Number of Contract * Multiplier |

| Indonesia Government Bond Futures (IGBF) | Rp10.000.000 | 0.01% (1 bp) | - 1% * Contract Size * Number of Contract * Futures Price (5 Year) - 2% * Contract Size * Number of Contract * Futures Price (10 Year) |

| IDX30 Futures | Rp100.000 | 0.1 Point Index | 4% * Index point * Number of contract * Multiplier |

| Basket Bond Futures (BBF) | Rp10.000.000 | 0.01% (1 bp) | - 1% * IGBF Price * Number of Contract * Multiplier (5 Year) - 2% * IGBF Price * Number of Contract * Multiplier (10 Year) |

Auto Rejection

JATS INET will automatically do the Auto Rejection to the derivatives' price orders input into the JATS INET if:

| Derivatives | Tick Size | Auto Rejection |

| LQ45 Futures | 0,05 (1bp) | 10% |

| Indonesia Government Bond Futures (IGBF) | 0.01 (1 bp) | 300bp from reff price |

| IDX30 Futures | 0,1 Point Index | 10% |

| Basket Bond Futures (BBF) | 1 bp (0,01%) | 600 bp |

Transaction Settlement

Settlement of Derivative Products is carried out by the KPEI through the Netting process and held with this provision:

| Derivatives | Transaction Settlement |

| LQ45 Futures | 1st Trading Day After Transaction (T+1) |

| Indonesia Government Bond Futures (IGBF) | |

| IDX30 Futures | |

| Basket Bond Futures (BBF) |

Click here for more information about Trading hours.

Derivatives Transation Fees

For derivatives transaction, the Exchange Members have to pay fees based on:

| LQ-45 Futures | IDX30 Futures | KB SUN & KBSSUN |

|

| Transaction Fee (exclude Clearing and Settlement) | Rp5.000,-/transaction | Rp3.000,-/transaction | Rp10.000,-/contract |

| VAT 12%* (Rate 12% x Tax Basis 11/12 of the Bill Amount)** |

11% from fees | 11% from fees | 11% from fees |

*Paid to the Exchange as compulsory contribution, in accordance to the prevailing provisions.

**Referring to PMK 131 of 2024, VAT Rate is calculated by multiplying Rate 12% of the Tax Base 11/12 of the Bill Amount.